Define Off Balance Sheet

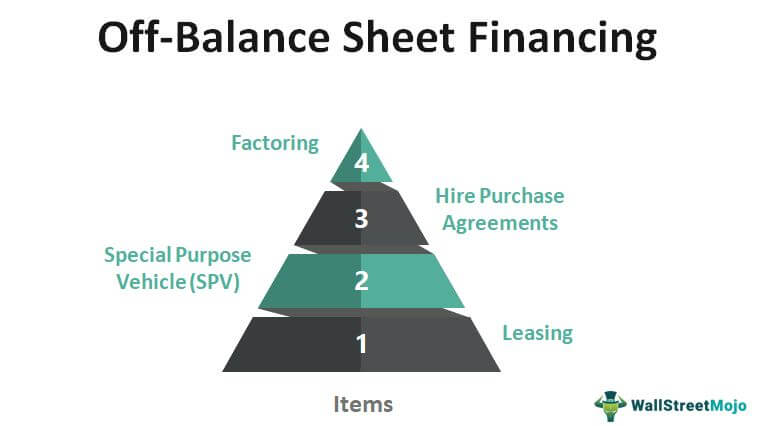

How Does an Off Balance Sheet Work. In off-balance-sheet financing large capital expenditures are kept off a companys balance sheet to keep the debt to equity DE and leverage ratios low especially.

Means any present or future financing transaction not reflected as indebtedness on the consolidated balance sheet of the Borrower but being structured in a way that may result in payment obligations by any Group member excluding any financing transaction in the form of.

. Off-Balance Sheet OBS Definition. Off balance sheet financing definition. The line of credit comes with a financial covenant that requires Company.

They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. When a company buys it outright it records the asset the equipment and the liability the purchase price. Off balance sheet financing is defined as the practice of not including certain assets or liabilities on a companys balance sheet¹.

Used to describe assets or debts that a company does not need to show on its balance sheet. Treatment of Rehypothecated Off-Balance Sheet Assets Section 106d of the proposed rule specifies how a covered company would determine the RSF amount for a transaction involving either an off-balance sheet asset that secures an NSFR liability or the sale of an off-balance sheet asset that results in an NSFR. What does off balance sheet mean.

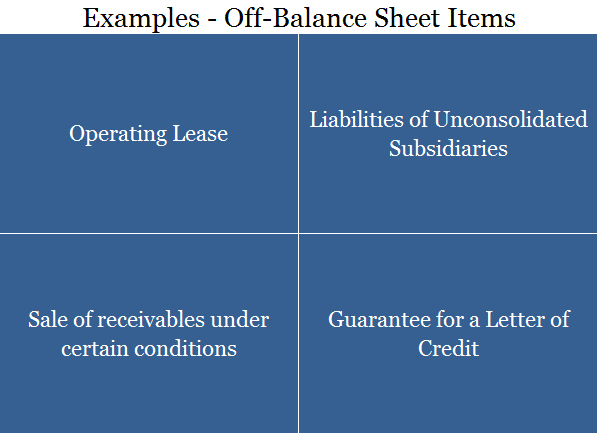

Examples of Off-Balance Sheet Assets in a sentence. In an operating lease the company records only the rental expense for the equipment rather than the full cost of buying it outright. Off balance sheet refers to items that are effectively assets or liabilities of a company but do not appear on a companys balance sheet.

Off-balance sheet is the classification of an asset or debt that does not appear on a companys balance sheet. They would not generally be removed especially if any transaction had been posted to the account. Off-Balance Sheet OBS Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage.

Off balance sheet financing is also sometimes referred to as incognito leverage as businesses can use the off balance sheet items as a type of leverage and show a. Information and translations of off-balance-sheet in the most comprehensive dictionary definitions resource on the web. Means liabilities and obligations of the Borrower any Subsidiary or any other Person in respect of off-balance sheet arrangements as defined in Item 303a4ii of Regulation S-K promulgated under the Securities Act which the Borrower would be required to disclose in the Managements Discussion and Analysis of Financial Condition and.

Least count of the physical balance may be as small as 001 g of 10 mg. Off-Balance Sheet OBS Definition. Information and translations of off balance sheet in the most comprehensive dictionary definitions resource on the web.

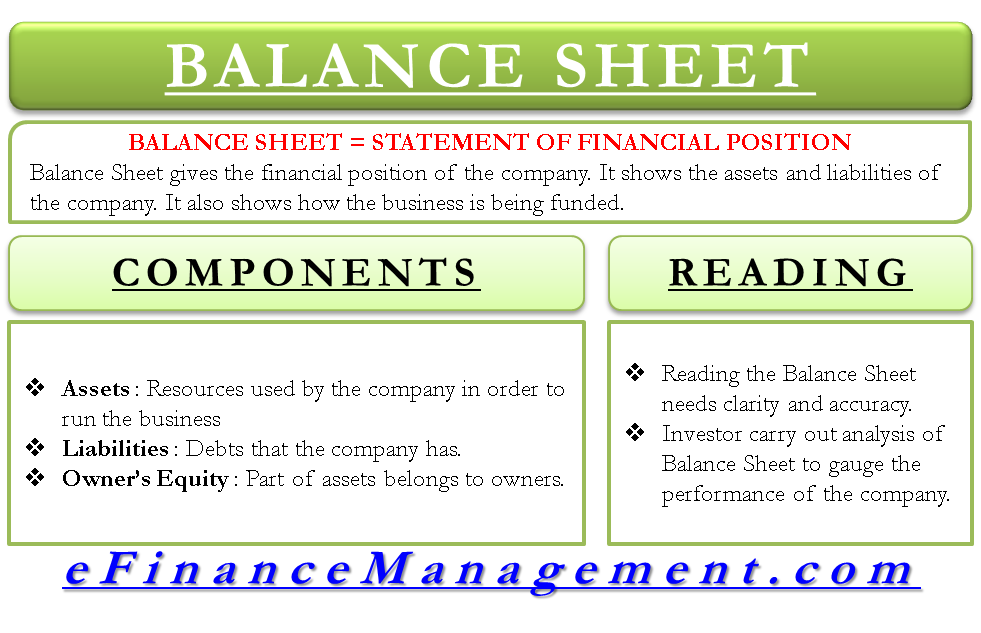

Off-balance sheet is the classification of an asset or debt that does not appear on a companys balance sheet. The purpose of a balance sheet A balance sheet is a snapshot of the companys financial position at a specific point in time. Examples of Off-Balance Sheet Financing.

For example lets assume that Company XYZ has a 4000000 line of credit with Bank ABC. Used to describe assets or debts that a company does not need to show on its balance sheet. So by the use of an operating lease the.

Define Off-Balance Sheet Obligations. Variable Interest Entity VIE. Off Balance Sheet Definition.

Off-Balance sheet items are generally shown in the notes to.

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Explanation Components And Examples

Balance Sheet Definition And Meaning

Comments

Post a Comment